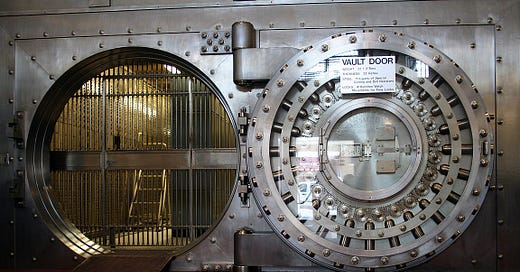

Why full-reserve banking isn't a solution to bank failures

Ensuring safety for depositors at the expense of bank lending comes with high economic costs.

A swathe of bank failures in the US, and the forced merger of two Swiss banking giants, has drawn advocates of full-reserve banking and its close relative, “narrow" banking, out from hibernation. Last seen in the aftermath of the financial crisis, these strange creat…

Keep reading with a 7-day free trial

Subscribe to COPPOLA COMMENT to keep reading this post and get 7 days of free access to the full post archives.